The subscription business model has become increasingly popular amongst both consumers and service providers. According to research, the number of subscriptions per person more than doubled from 2.2 in 2018 to 5.3 in 2024 and the global subscriptions market is expected to exceed $1tn by the end of 2028.

At the same time, consumers are struggling to pay and manage the growing number of subscriptions they own, which may represent a threat to adoption of new services that implement a subscription-based service.

One potential solution to that problem can be bundling the subscription-based product with Telco services or Super bundling. Yuri Berchenko, head of product partnerships at YouTube, shares whether Super bundling will “save” the subscription business model and how subscription-based services can benefit from Bundling opportunities with Telcos and not only with them.

The subscription business model is being ever more widely adopted amongst service providers, owing to its greater predictability for revenue. In 2018, there were an estimated 1.3 billion subscriptions to services such as digital music, streaming services, video game subscriptions and delivery services. However, by 2026, this is expected to rise to over 4.2 billion.

More and more digital services and products are moving to a subscription model. Service providers prefer subscriptions over one-time payments because of their revenue predictability and their tendency to boost average revenue per paying user. They also make customers stick around for longer.

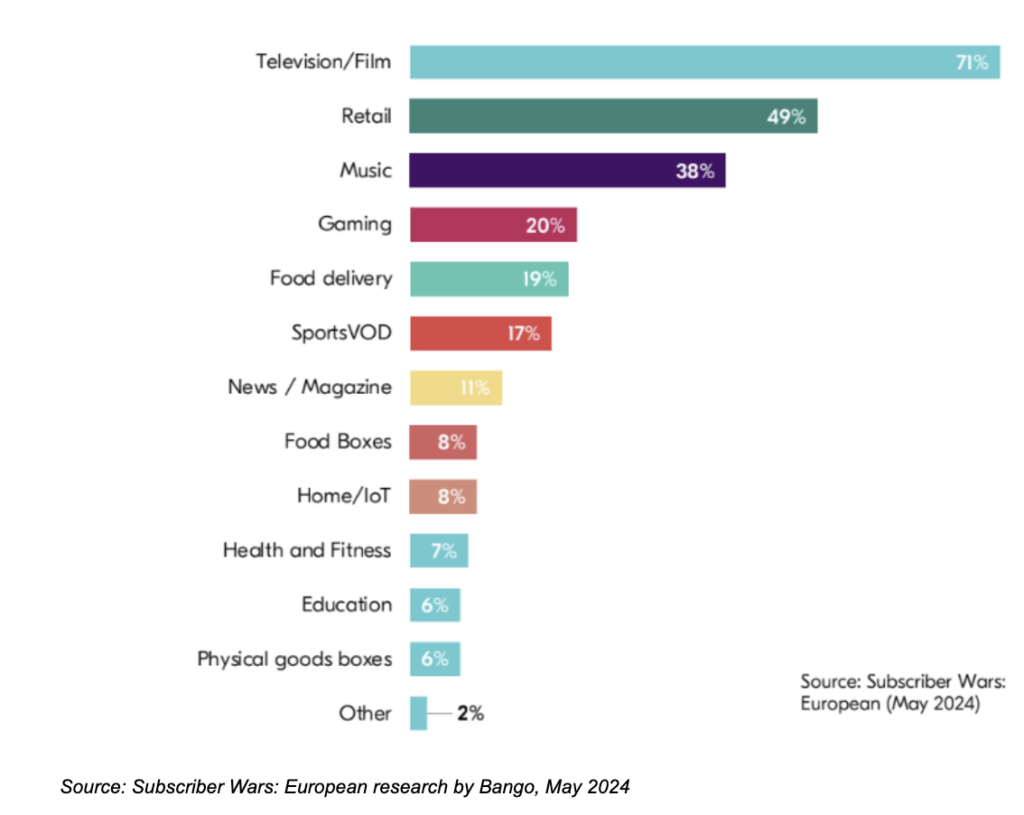

Not only are subscriptions becoming the norm for content services but are also making strides in the physical goods and services space. Historically being widely adopted by the music and video entertainment industry – just to name Spotify and Netflix – now it is hard to name a few areas where the subscription business model is not presented. Think about food delivery, retail, gaming, education, health and fitness and productivity: now the subscription business model spanned among a great variety of industries.

Overall we can distinguish about the following 11 categories on subscription business:

- Digital Music. This includes music streaming services such as Amazon Music, Apple Music, Spotify, Tidal, Deezer and Anghami.

- Video Streaming. This includes video streaming services such as Netflix, Amazon Prime Video, Apple TV+, Disney+, Eros Now, Max, ONS+, Paramount+, Shahid, Showmax, Starz Play and YouTube Premium.

- Video Games. This includes subscriptions to access video game content including Xbox Games Pass, PlayStation Plus, EA Play, Apple Arcade and Google Play Pass.

- Digital Spoken Word. Subscriptions to premium content such as podcasts and audiobooks, including services such as Supercast.

- Delivery Services. Solutions for the regular delivery for food or nutrition services on a subscription basis, such as Amazon Prime and Deliveroo.

- Physical Good Boxes. Subscriptions for the regular delivery of physical goods, such as hygienic products. Services include Apron and HelloFresh.

- Fitness & Wellness. Subscriptions for digital services in the health and wellbeing space, including meditation apps, digital content on health and online wellbeing services, such as Calm and Headspace.

- Mobility-as-a-Service. Subscriptions to multimodal transport services in which a user pays a recurring fee for access to transport rather than multiple one-off fees, such as Uber One.

- Productivity. Solutions such as Microsoft 365 and other productivity tools are offered on a subscription basis.

- Social & Education. Educational software, such as Duolingo, and examples of premium social software can be offered via a subscription.

- Security. Solutions, such as Norton, are offered for a monthly fee.

The popularity of the subscription business model would not happen if it would not be convenient for the end user. Customers also benefit from the subscription as it provides access to all content, replenishment of basic goods, and curation of personalised experiences.

As a result, a subscription business model is winning share of the consumer wallet too. Latest numbers published by Bango revealed that for example average monthly spend on subscriptions in the UK exceeded £58 and more than one of eight consumers spend more than £100 per month for subscription services.

The more widespread subscriptions become, the more subscriptions people end up signing up for. Consumers are drawn by the convenience of services offering all-you-can-eat content and automatic replenishment, as well as the indulgence of services delivering select goods for personalised experiences.

Subscription Fatigue

Off-the-chart success of the subscription economy also poses a problem – consumers are overwhelmed by the sheer volume and fragmentation of digital product and service subscriptions. So-called subscription fatigue is a growing phenomenon. People are struggling to remember how many subscriptions they have in their name; how many are still in their free trial period and how many have already started charging; and when payments are due. And they are having to manage a separate billing relationship, login, and communications channel for each subscription.

This leads to a consumer conundrum: on the one hand, consumers are demanding for more choice and more services offering a subscription model with all its benefits, and at the same time they are overwhelmed by the sheer volume and fragmentation of digital product and service subscriptions. As a result of that, consumers are struggling to pay and manage the growing number of subscriptions they own.

And consequently the digital-service providers operate in an increasingly crowded space, in which getting noticed and winning new customers is expensive. These days the subscription providers are finding it increasingly expensive to acquire new users. Another big challenge is that many of them are being undercut by tech-giant service bundles, such as Amazon Prime and Apple One.

Super Bundling

The solution for that problem for both consumer and subscription providers is Super bundling. The concept is simple.

It is a new kind of offering allowing consumers to subscribe to a wide array of services via a single place and one bill for easy management and content discovery, as well as price discounts. It revolves around a content hub that brings together dozens of subscription services — all in one place and as part of one monthly bill.

Super Bundling provides customers with access to a huge range of subscription services, managed through – and paid for – via a single services hub. These Super Bundling hubs are in high demand, with 79% of US consumers saying they would be ‘more loyal’ to a company that provides an all-in-one subscription hub service.

Typically, Super Bundling could be done by a telco although it’s a viable strategy for other verticals as well. In the US, many subscribers saw bundling as an evolution of cable television for the streaming age. As such, the majority expected cable companies to lead the charge when it came to developing and launching these all-in-one content hubs. However, recently the landscape has shifted with many consumers now looking beyond streaming services for more inclusive all-in-one subscription platforms. In this environment, telcos have fast become the go-to choice for Americans looking to centralise their subscriptions.

Of course, organisations like telcos are no strangers to bundling. The bundle concept itself took off when they started packing their own services – such as data, call time and SMS and later PayTV packages – as part of their bills. That is why “Telcos” should be seen as shorthand for mobile, fixed broadband, and pay TV operators. In fact, Telcos are one of the oldest subscription businesses around and, increasingly, other businesses are turning to them as a channel to market for their own subscriptions, drawn by their huge distribution, marketing, and billing muscle.

And as this model became more successful, telcos became more creative, branching out to offer subscriptions, such as music, video, sports and movies. In today’s world Telcos are major distributors of digital subscriptions. Already, a fifth of all online video subscriptions globally – 20% (!) – are sold via telcos, and in some parts of the world – such as the Middle East and Africa – this number is getting even closer to 30%.

Music industry is getting not far: according to Omdia in Music streaming $4B has been derived from mobile bundles. Taking into account that the total streaming market reached $25.8B in 2023, then mobile bundles account for close to 15% of total volume of the music streaming industry payouts.

More and more users are starting to be more aware about the benefits of signing up indirectly. For example, in the US 1 of 5 subscribers sign up exclusively via indirect channels avoiding the traditional subscription process altogether. What values do these indirect subscription methods provide to the end user? There are three of them:

- Savings. Many bundling offers include extended free-usage periods or discounted pricing – and a growing share are doing so indefinitely. The savings that these offers bring are an obvious magnet for consumers – for example in the US, 29% of subscribers who sign up exclusively via indirect channels receive their subscriptions for free as part of a bundle – more so now that the cost-of-living crisis and recessionary pressures have put a big squeeze on consumer spending.

- Convenience. Telcos have already got consumers used to paying for several services on one bill – mobile, landline, fixed broadband, TV – and putting other subscriptions on that bill only adds to the convenience of managing many payments via a single point, rather than juggling numerous billing relationships with different providers.

- Control. Most consumers do not feel in control of all the subscriptions they own (as already covered above). There is an appetite for services that can centralize and simplify subscription access and management.

Finally we are approaching the most important question, which was at the title of this article – Why should digital services consider bundling their subscription product and how they should expect to benefit from it? For providers of subscription-based digital services, bundling is essentially about tapping into the distribution, marketing, and billing power that telcos have in local markets. The following is what they hope to get out of bundling:

- Cheaper and Swifter User Acquisition. A lot of marketing dollars are required to standout in direct-to-consumer (D2C) channels such as app stores and browsers. When telcos bundle third-party services, they do not just single them out from the crowd, but take care of the marketing and foot most of the cost of any free or discount offers that are made. Bundled services also instantly tap into a captive audience of millions of telco subscribers. Digital service providers sacrifice some of their margin by selling subscriptions at a wholesale discount but acquire users far more swiftly than via D2C channels, without having to spend a penny on marketing or pay a revenue share to D2C gatekeepers.

- Conquering New Markets. In new markets that digital service providers are expanding to, piggybacking on the “brand equity” enjoyed locally by telcos can make all the difference. A telco’s endorsement does not only add visibility to a market newcomer, but also trustworthiness.

- Increasing Addressable Market. Not everyone has the means or the willingness to make online payments. In emerging markets, credit/debit card penetration tends to be very low and, in all markets, some consumers are wary of sharing their payment details with online outlets. By selling their subscriptions via telcos, OTTs can tap into a wider base of payment-ready users.

- Higher Paid-User Conversion Rates. The longer free-usage periods usually offered in bundling, and the billing relationship that telcos already have in place with their subscribers, mean that telco bundle users are more likely than D2C users to turn into paying customers when free-trial periods come to an end.

- Stickier Users. Integrating subscriptions with tariff contracts locks them in for the duration of those contracts – for one or two years or, as is increasingly the case, indefinitely. In a super bundling context, getting users to purchase subscriptions in bundles can potentially make them less likely to cancel those subscriptions, especially if a discount is offered on their aggregated price.

Where do I start?

Super Bundling gives digital service providers instant access to a ready-made distribution, marketing and billing network offered by telcos and other channels around the world. Several global telcos have already created their own vibrant subscription hubs – bringing together dozens of providers from streaming, music, gaming, education, productivity and wellness and more categories.

One example is +play, which is a service for people with a mobile contract from Verizon, the largest Telco in the USA. It allows you to manage lots of subscriptions from one place.

With most of these services, you can’t easily switch over to +play billing if you’re already a subscriber. Instead, you’ll need to cancel the subscription, then sign up again through Verizon’s system.

Similar services has been recently launched by other Telcos in various parts of the world, including SubHub by Optus in Australia, Centro de Entretenimiento by Orange in Spain and Extras by O2 in Germany.

And if you’re not in the best position to start negotiating with telcos directly or your product team is small you may want to consider approaching one of the industry system integrators which are bringing together telcos and digital service providers in one place. To name a few these could be Bango, Boku, Amdocs, Mondia and Bundler.

By adopting Telco Building, subscription providers and other brands can quickly join up with hundreds of other subscription services to build engaging offers targeted at different customer segments to create compelling content hubs to consumers.

Obviously Bundling is not a “no strings attached” thing, you still might need to allocate a decent amount of engineering resources to enable billing integration and on a commercial side be ready to give a reseller discount – but the game worth it, because you can get your product in front of hundreds of millions of potential subscribers within weeks.

Some of the biggest players in the market including Netflix, Uber and Amazon and more are already part of the Super Bundle, now this is your time as well.

Following the second edition of the groundbreaking SubscriptionX conference in May, RetailX Events is delighted to announce the launch of a unique practitioner-led event, exclusively for those working in subscription brands.

Join us for SubscriptionX II – an exclusive think-tank which will explore how leading subscription businesses and challenger brands are focussing on retention as a key driver of growth, using a data-driven approach to define and refine their strategy, and creating exceptional subscriber experiences to increase customer lifetime value.

Stay informed

Our editor carefully curates two newsletters a week filled with up-to-date news, analysis and research, click here to subscribe to the FREE newsletter sent straight to your inbox and why not follow us on LinkedIn to receive the latest updates on our research and analysis.

How should a subscription service approach a SuperBundle opportunity? #subscription #service #approach #SuperBundle #opportunity

Source Link: https://internetretailing.net/how-should-a-subscription-service-approach-a-superbundle-opportunity/

How should a subscription service approach a SuperBundle opportunity?:

The subscription business model has become increasingly popular amongst both consumers and serv…