Business

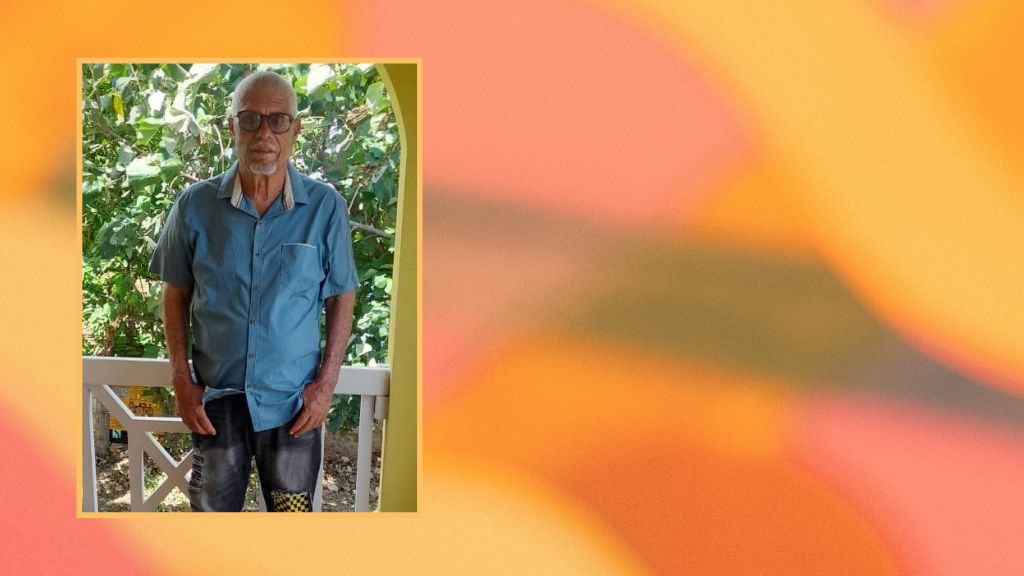

For the past 43 years, 67-year-old Winston Gordon, a well-known fish vendor in Treasure Beach, St Elizabeth, has been the source of fresh fish for residents.

Gordon has provided fresh catch to various communities in St Elizabeth, Manchester, and up to a few years ago, St James.

Every Monday, Wednesday and Friday, he would go by the seaside as early as 6 am to obtain his fish supply from fishermen.

He would store the fish in his deep freezer and venture out three times per week, going from house to house, to supply his customers.

Winston Gordon, fish vendor in Treasure Beach, St Elizabeth. (Photos: Contributed)

However, since the passage of Hurricane Beryl on July 3, his routine has changed drastically.

The hurricane caused substantial damage to houses, including Gordon’s, in south coast communities, leaving residents without electricity for months.

‘I lost the whole roof. Only one room [was not badly affected] but [the roof] was still leaking,’ he said, adding that his mattresses were destroyed and some of the furniture was damaged.

Although electricity has been restored recently, Gordon is unable to resume his business as he is currently focused on restoring his roof.

Having previously lost his roof during Hurricane Dean in 2007, the senior citizen has decided to install a slab roof this time to better protect against future hurricanes.

Sharon Smith, head of the Business Banking Division, JN Bank. (Photos: Contributed)

He expects the restoration to be completed by October. In the meantime, Gordon and his wife are staying at his brother-in-law’s house nearby.

The business disruption has been devastating for him. The connections he has built over the years, both with the fishermen and his loyal customers, who rely on his supplies, have been adversely affected.

‘I feel like a fish out of water,’ he lamented, seemingly playing on words. ‘We can’t do anything without electricity. Buying ice is expensive. When you have your fridge to put your fish in, it is so handy.’

Gordon mentioned that the hurricane has also disrupted the business of fishermen. As it relates to his customers, Gordon said that he has been in touch with a few of them.

‘Up until now, they still haven’t found some of the [fish] pots at sea. They don’t catch a lot of fish either,’ he stated.

The lack of income has also hit hard, as fish vending was his primary source of livelihood. Now that he is temporarily out of business, his children and sisters have been assisting with expenses.

Gordon’s situation is a stark example of the vulnerability that small and micro businesses face when confronted with natural disasters, such as hurricanes.

Something Sharon Smith, head of the Business Banking Unit at JN Bank, understands very well.

‘When disasters strike, they often leave small businesses grappling with the aftermath, struggling to recover from the sudden disruption to their operations. As Jamaica is prone to calamities such as hurricanes and earthquakes, it’s crucial for businessowners to have strategies in place to mitigate business disruption. A well-prepared business is better equipped to survive despite unexpected challenges,’ she explained.

She highlighted that the impact of a hurricane extends beyond physical damage to property as hurricanes can severely disrupt operations by cutting off critical services and channels.

‘For businesses like Mr Gordon’s, which depends heavily on refrigeration and other utilities, losing power isn’t just an inconvenience, it’s a crippling blow that can halt operations entirely.’

Smith reiterated the importance of preparedness and the need for small and micro businessowners to implement contingency plans to navigate business disruptions.

The business banking expert further emphasised that small businessowners can take several proactive steps to safeguard their operations against disaster-related disruptions.

These, she said, include:

Creating a business continuity plan by developing a detailed course of action, outlining steps to take before, during, and after a disaster.

Diversifying revenue streams. Consider creating another income stream to reduce reliance on a single source. This could include offering new products or services.

Investing in backup systems. Install backup power systems, such as generators or solar power, to maintain business continuity during power outages.

Maintaining emergency cash reserves. Keep an emergency fund to cover operating expenses during periods of reduced income or increased costs due to repairs and recovery efforts.

Maintain contact with customers and suppliers. Communicate with customers and suppliers about the business’s status, expected downtime, and any changes in operations.

Leveraging government assistance. Explore available assistance programmes and grants being provided by the government to support small businesses affected by the disaster.

In closing, Smith urged that ‘these strategies are effective for small businessowners in helping to better manage downtime in the event of future disasters’.

‘Preparedness not only ensures that operations can resume quicker’, she says, ‘but also strengthens the overall business’.

‘In the long run, these proactive measures can safeguard livelihoods, ensuring that small businesses bounce back [faster] after a disaster,’ Smith maintains.

“This is another glamorous plug-in.”

“Hurricane Beryl present ongoing challenges for many small businesses krodgers Wed, 09/04/2024 – 15:22…”

Source Link: http://jamaica.loopnews.com/content/hurricane-beryl-present-ongoing-challenges-many-small-businesses

#Business – BLOGGER – Business