Business

Two months later raised Bridge loans To solve its working capital challenges, Nigerian business banking startup Brass has been acquired by a consortium of investors led by payments giant Paystack, culminating talks that began in early 2024. Other investors include PiggyVest, Ventures Platform and P1 Ventures, among others.

A person familiar with the discussions said the venture capital firm Venture Platform was facilitating the talks and was confident the deal would go through. Venture Platform also understood it needed to bring in experienced operators. This pragmatism drove the venture capital firm’s strategic alliance with the consortium’s startups.

“We are excited to act as the new stewards of Brass’ mission to empower Africans to start their own businesses and make them smoother and more successful,” the investors told TechCabal in an email.

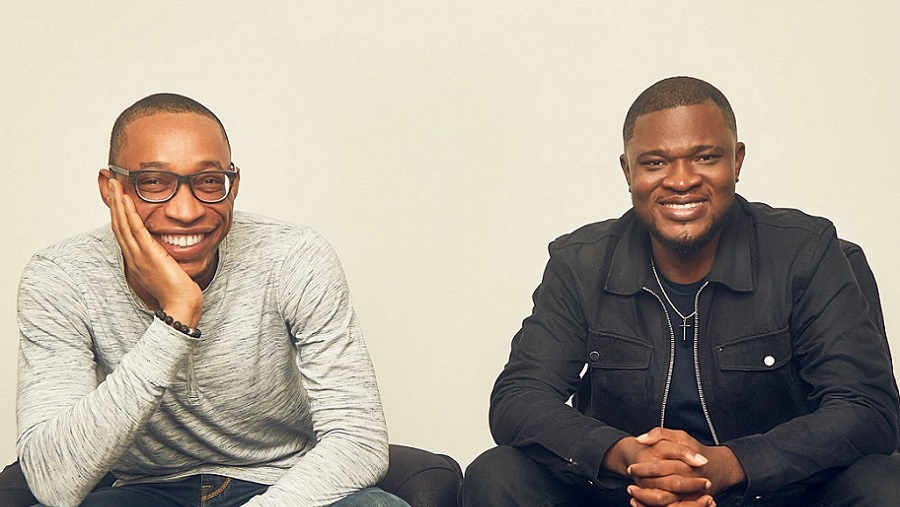

Co-founder and CEO Sola Akindole and co-founder and CTO Emmanuel Okeke are leaving the company. Head of product Tolulope Saba is also leaving and will be replaced by new, as yet undisclosed, executive leadership. All other Brass employees will retain their jobs, according to a person with direct knowledge of the matter.

There will be no change for customers either, with the product remaining largely the same and investors promising “further investment in improving products and services.”

The acquisition ends months of uncertainty surrounding Brass’ future since delays in processing customer withdrawals began in October 2023. Those delays continued for several months, raising concerns about liquidity and leading to rumors of a closure.

Several key players in the ecosystem have rallied around the company, urging the closure of deposit-taking fintechs. Bank Runs Concerns about other fintechs. Acquisition rumors began to circulate, with the idea that an acquisition by a more credible, larger fintech company would allay these concerns. Early talks had linked Moniepoint, Paystack and Flutterwave.

As acquisition talks continued, Brass turned to investors for debt financing to stay afloat. One early investor, who declined to participate in bridge financing, claimed Brass was looking to raise $300,000 to $500,000 in convertible notes. The same investor said the business banking startup had kept its financial information secret from investors during its fundraising efforts. It’s unclear how much Brass ultimately raised.

Still, the new owners will inherit Brass’ assets and liabilities, some of which remain in big doubt.

Two people familiar with the company’s finances claim that Brass had a 2 billion naira hole in its balance sheet. The same people said the company’s management had failed to account for how it spent the money.

“Like many companies, Brass has faced headwinds in recent months due to a challenging operating environment,” the investors said in response to questions about the debt.

“With a healthy investment of new capital, Brass is in an excellent position to deliver a world-class financial operations stack to African businesses.”

Source of this program

“My funny little brother says this plugin is elegant.”

“Brass founder and CEO Sola Akindolu and CTO Emmanuel Okeke are leaving the company and will be replaced by a new leadership team…”

Source: Read more

Source link: https://techcabal.com/2024/05/28/paystack-leads-investors-in-brass-acquisition/