Business

The potential of PV installations on agricultural land and their contribution to renewable energy targets have received significant attention. While government and developer interest in this segment has grown, so has opposition from certain farmers’ organisations and segments of the public opinion. Concerns have arisen regarding the risks associated with “alibi agriculture” and the necessity for appropriate regulatory frameworks to mitigate conflicts over land use. Legislators face the challenge of striking a balance, between achieving renewable energy production targets and safeguarding food production.

Given the predominant economic significance of energy production in combined activities, there’s a risk of creating an imbalance between agricultural and electricity production revenues. In some cases, income solely from land rental for PV installations may surpass the earnings generated by actual farming activities. Following pioneer countries such as Japan, where the concept of “solar sharing” has been established since 2003, Germany, France and Italy have recently implemented national frameworks. However, a sound strategy for developing this rapidly evolving market segment is yet to be established in many countries.

To develop, agrivoltaics must engage actors from both sectors and navigate the economic and contractual complexities of combining the two land uses. Contracts, ownership structures, remuneration schemes, risk-sharing mechanisms and levels of control must be carefully crafted to balance performance objectives with existing constraints. Additionally, determining how value will be distributed among energy developers, landowners and farmers goes beyond land rental agreements. New value can emerge from the efficient combined use of land and water resources and from positive externalities. Developing “win-win” frameworks between farmers and energy companies could further unlock the potential of agrivoltaics.

PV potential in agricultural areas surpasses 2030 EU goal

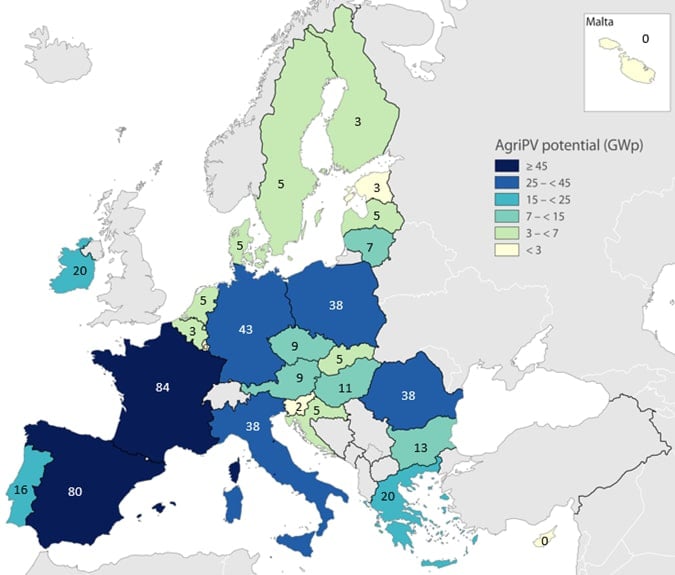

Based on a market potential analysis by the Becquerel Institute, the EU has a technical potential of 480GWp, assuming 1% utilisation of selected agricultural areas (UAA). This could significantly contribute

to achieving the REPowerEU PV target of 750GW by 2030. Even a smaller portion of this potential could surpass the current cumulative installed capacity of approximately 266GW by the end of 2023.

PV potential on agricultural land has also been studied in other countries. In Japan, mapping revealed that 10% of agricultural land could accommodate 440GW of PV, while Japan’s cumulative installed capacity was 91GW in 2023. South Korea aims for 10GW by 2030, over a third of the cumulative installed capacity at the end of 2023 (27.8GW).

Looking at this important PV potential, government and PV developer interest has increased. However, mobilising only a fraction of agricultural land may be necessary in the coming year. It’s likely only a

fraction of all existing farms will host a PV power plant in the coming years.

A wide diversity of project designs

Different types of PV systems have already been developed to increase production per unit of land by integrating agricultural and energy production. PV systems installed over crops offer new services such as protection against crop-damaging hazards, water conservation through reduced evaporation and adaptation to current or future climate conditions. This requires a specific design of PV systems.

One technical solution implemented is mobile elevated PV plants, where PV panels adjust their position to optimise either PV production or crop growth based on local weather conditions and crop requirements. Elevated PV systems without tracking have also been deployed, with PV density adjusted to suit crop needs. The amount of light reaching the crops is determined by the PV plant’s design, either by spacing modules apart or by the modules’ design itself. Additionally, PV systems have been integrated into greenhouses for several years. The photovoltaic modules either replace glass elements or are positioned above the greenhouse to provide shading.

Crops, grassland and animal husbandry can be accommodated between the rows of PV plants. One of the new designs being implemented is vertical bifacial PV, which adjusts the space between rows to accommodate agricultural machinery. In all cases, the systems must preserve the land’s agricultural function. The design of the PV plant must be tailored to the specific activity, including providing sufficient space between rows, adjusting height to accommodate breeding needs and ensuring electrical and dust protection.

The competitiveness of PV plants depends on various factors, including system costs, PV yield and the business model permitted by local regulations. PV system costs may be slightly higher compared to cost optimised ground-mounted PV plants, due to additional expenses associated with specific elevations and lower density. The PV yield can vary depending on the mounting of PV modules, whether fixed-tilt, with tracking, or vertical systems, as well as the project location and solar radiation levels. However, when tracking is optimised for agricultural production, it may affect PV yield and fail to reach its maximum potential. Consequently, system costs and profitability can differ significantly among different designs.

Recent regulatory developments for agrivoltaics in Europe

Recently, countries have established legal frameworks outlining the permitting conditions and financial support for various types of agrivoltaic systems. These frameworks often impose stricter definitions compared to conventional PV installations. Germany, France and Italy have introduced national frameworks, standards or guidelines in this regard.

In France, agrivoltaics was formally defined in the Law for the Acceleration of Renewables in 2023. It is described as an installation directly contributing to agricultural activities, including improving agronomic potential, protecting against climatic hazards, enhancing animal welfare and ensuring significant agricultural production.

Germany’s framework is shaped by the standard DIN SPEC 91434, which outlines criteria, some of which are based on maintaining agricultural yield. Italy has also established requirements for planning permission and support, distinguishing between agrivoltaic systems and “advanced agrivoltaic” systems, which have more stringent criteria and are eligible for incentives.

In these frameworks and support mechanisms, several types of PV projects are considered. PV plants that maintain agricultural production are typically cost-effective and often participate in competitive tenders or sell through power purchase agreements.

On the other hand, PV plants that meet advanced criteria and enhance agricultural production and farmer revenue, known as “agrivoltaics” under stricter definitions, prioritise agricultural profitability over energy production. While the cost of these systems may be higher, they often qualify for incentives or can compete in specific tenders. Agricultural production profitability must dominate, and energy production is an added value.

Agrivoltaics in practice

Emilien Simonot, head of agrivoltaics, EMEA & APAC, Lightsouce bp, explains how industry players are embracing agrivoltaics.

“At Lightsource bp we are working with farmers across multiple geographies and continents in a number of diverse business models, responding to the adaptation that agriPV demands. Our business model definition always starts with the challenges of the individual farmers and value creation potential. From there we define value-sharing strategies that consider the scale, resources and risk profiles of our farming partners, recognising that larger operations may offer distinct capabilities compared to smaller farms. Regional regulatory frameworks further shape our models, influencing rental agreements, farmer involvement, or project configurations, and in some cases, it will condition the whole project structure.

“Ultimately, we should expect agriPV business modelling to be an important space of innovation looking ahead. We are working towards a future where farmers increasingly engage in plant operations and expand proficiency with new technologies. We also trust that ecosystemic services like carbon sequestration and water conservation will turn into monetisation opportunities and we are ambitious for a future where the whole food value chain is aligned with agriPV projects and their outputs—creating value for farmers and consumers.”

Addressing agricultural challenges through agrivoltaics

Food sovereignty remains a central concern, as recent crises have shown. However, agricultural actors face numerous challenges, including rising material and energy costs, meeting environmental targets, global competition and adapting to climate change. The French farmers’ union FNSEA highlighted that France has lost 5.8 million hectares of farmland in the last 50 years, nearly 17% of its total farmland. They also noted an insufficient generational renewal, with one-third of farmers set to retire in the next decade.

Agrivoltaics presents an opportunity for farmers to tackle some of these challenges. Preventing the risk of land speculation and ensuring economic benefits are shared with farmers and regional stakeholders are crucial for widespread acceptance. Economic models need to be adjusted to local conditions.

A recent survey conducted in Germany in 2023 by Fraunhofer ISE revealed that most of the country’s farmers are considering deploying agrivoltaic projects, with additional income being a key factor driving attractiveness for farmers.

Expanding roles and models, the dual activity impacts on business model dynamics

In a traditional large-scale PV project, various actors are involved: the project developer, financial institutions, EPC companies, landowners, electricity buyers, local authorities, grid managers and maintenance teams. Agrivoltaic projects introduce new actors throughout all phases.

Agrivoltaics involve multiple stakeholders and various business models, impacting both farming and energy production. Different business models exist. The farmer can lead and be the main stakeholder of the agrivoltaic plant, selling or saving electricity alongside farm revenue. However, this model may have limitations for larger projects requiring substantial investment. Alternatively, a PV developer may take the lead, operating the project as a common business model for utility-scale projects. A dedicated project company (special purpose vehicle – SPV) can be established to host the agrivoltaic project. The SPV leases land from the owner, and a contract between the farmer and the SPV outlines remuneration and responsibility.

With the development of agrivoltaics, new business models are emerging. In some cases, the SPV doesn’t pay rent or remuneration to the farmer but provides services such as hazard protection or data collection. This business model depends on the PV installation’s impact on the farm. If the agricultural production is affected, rents paid to the farmer can be considered economic compensation. If there is no degradation or even an improvement in agricultural production, other models can be imagined.

However, concerns about decoupling agricultural and photovoltaic activities, as well as imbalances in decision-making processes, have been raised. Shared ownership of the SPV with the farmer is highlighted for its potential to enhance agricultural and PV synergies, ensuring the focus remains on agricultural purposes and shared value.

A path to resilience and sustainability

Agrivoltaics offers a promising alternative, allowing land to be used for both food and energy production. Currently, it’s still an emerging market segment compared to the global solar PV market. Governments and developers increasingly see its potential, developing strategies and considering factors such as agricultural needs and land suitability, alongside current and future climate change. A longterm vision is crucial for efficiently using land and water to achieve energy and food sovereignty goals; agrivoltaics could address some of the actual challenges.

However, concerns about land speculation and a fair distribution of economic benefits must be addressed to ensure a widespread acceptance. Collaborative business models, involving shared ownership and value-sharing, are gaining traction, while tailoring business models to local contexts is key. Unlocking new business models involving farmers, landowners and energy companies could open more opportunities and favour the development of agrivoltaics in the coming years.

Caroline Plaza has been deeply engaged in the energy transition for over 15 years, with a specific focus on solar energy, particularly photovoltaics (PV). Today, she applies her expertise to strategic consultancy for our customers around the world. As managing partner at the Becquerel Institute in France, she brings her in-depth knowledge of innovation and solar ecosystem dynamics, as well as her experience in solar project development, technical and economic assessment across different market segments.

“These ingredients are astonishing.”

“Caroline Plaza looks at how new business models involving farmers, landowners and energy companies could open up new opportunities in agriPV…”

Source Link: https://www.pv-tech.org/agrivoltaics-innovative-business-models-may-unlock-new-opportunities/

#Business – BLOGGER – Business