Sample description

The manufacturing industry accounts for the largest number of firms in the survey data, occupying 53.1%, followed by the Internet and software industry, at 11.3%. The proportions of other industries, such as catering, retail, real estate and finance industries, are relatively small, ranging from 1.6% to 5.4%. Nearly half of the enterprises (46.8%) have been established for more than 20 years, while only 9.7% have been established for between 1 and 3 years. In terms of the nature of ownership, private enterprises dominate the sample, accounting for 51.6%, while state-owned enterprises and wholly foreign-owned enterprises occupy 18.8% and 19.9%, respectively. In terms of enterprise size, most enterprises (63.3%) have more than 500 employees. In terms of the distribution of positions participating in the questionnaire survey, top managers account for 33.3%; middle and junior managers account for 28.5% and 23.7%, respectively; and ordinary employees account for 14.5%. Among the survey participants, those with postgraduate degrees account for 49%, while those with bachelor’s degrees account for 43%. In terms of the distribution of their departments, technology/R&D account for the largest number of people, at 40.2%, followed by the company’s management and marketing departments, accounting for 17.8% and 17.2%, respectively.

Reliability check

In this study, the internal consistency of the survey instrument is assessed by Cronbach’s alpha coefficient for the variables digital technology, digital products, network embeddedness, knowledge acquisition, knowledge digestion, knowledge transformation, knowledge application and innovation performance, which correspond to Cronbach’s alpha coefficients of 0.910, 0.807, 0.859, 0.872, 0.907, 0.904, 0.945 and 0.948, respectively. These results show that the internal consistency of the variables is generally high, especially in the knowledge application and innovation performance dimensions, where the Cronbach’s alpha coefficients exceed 0.940. These results show that the constructs are highly reliable Tables 1–3.

Validity analysis

The table shows that the commonality values corresponding to all the research items are greater than 0.4, indicating that research item information can be effectively extracted. In addition, the Kaiser–Meyer–Olkin (KMO) value is 0.958, which is greater than 0.6, indicating that the information extraction approach is effective. In addition, the variance interpretation rates of the three factors are 29.809%, 21.634%, and 20.532%. The cumulative variance explained after rotation is 71.976%, which is greater than 50%, meaning that the amount of information in each research item is effectively extracted.

Correlation analysis

Correlation analysis is performed using SPSS 23.0 to explore the relationships among the variables, and the results are shown in Table 4.

This table shows the correlation coefficients between firms’ digital transformation and absorptive capacity, network embeddedness and innovation performance—0.821**, 0.818**, and 0.741**, respectively—which shows a significant positive correlation. The correlation coefficients between absorptive capacity and network embeddedness and innovation performance are 0.882** and 0.863**, respectively, indicating a strong positive correlation. The correlation coefficient between network embeddedness and innovation performance is 0.762**, indicating a significant positive correlation.

Multiple linear regression analysis (MLRA)

In this paper, the theoretical hypotheses are tested using SPSS 23.0. MLRAs are conducted with digital transformation as the independent variable, innovation performance as the dependent variable, network relational embeddedness as the moderator variable, absorptive capacity as the mediator variable, and industry where the firm is located Table 5.

Based on the results of the stratified regression analyses provided, the results of the hypothesis testing are as follows:

H1: Digital transformation has a positive impact on corporate innovation performance.

In Model 2, the coefficient of the digital transformation of enterprises is 0.831, and the significance level reaches 0.01. Therefore, this finding supports H1, which states that digital transformation has a positive impact on enterprise innovation performance.

H1a: Digital technology has a positive effect on corporate innovation performance.

In Model 3, the coefficient of digital technology is 0.732, and the significance level reaches 0.01. This finding supports the conclusion of H1a that digital technology has a positive impact on firms’ innovation performance.

H1b: Digital products have a positive effect on corporate innovation performance.

In Model 4, the coefficient of digital products is 0.653, and the significance level reaches 0.01. This finding supports the conclusion of H1b that digital products have a positive impact on firms’ innovation performance.

H1c: Digital platforms have a positive effect on firms’ innovation performance.

In Model 5, the coefficient of the digital platform is 0.688, and the significance level reaches 0.01. This finding supports the conclusion of H1c that digital platforms have a positive impact on firms’ innovation performance. In addition, from the values of R², adjusted R², and ΔR², it can be seen that the explanatory variables included in each model contribute significantly to the explanatory power of the dependent variable (innovation performance). The presented tabular results support the validation of all hypotheses.

The significant positive impact of digital transformation on firms’ innovation performance highlights the need for firms today to adapt to the digital age. As technology advances, consumer behavior and needs are changing rapidly. Firms need to keep up with these changes to remain competitive and exploit new opportunities. While all three factors—technology, products and platforms—fall under the umbrella of digital transformation, the impact of each factor on a business’s innovation performance highlights its importance. This situation acts can act as a reminder for companies not only to have an overall strategy for digitalization but also to pay attention to the segments and develop a clear strategy for each segment. Although the coefficients on industry profile and time of establishment are not significant in most models, this does not mean that they do not have an impact on innovation performance. A possible explanation for this is that the impact of these variables is weaker or more complex than is that of digital transformation. These findings provide practical guidance for companies. To improve innovation performance, firms should consider digital transformation and segment their strategies into areas such as technology, products and platforms. In addition, depending on the nature of their ownership and size, firms also need to consider how best to undertake these transformations.

Model 2 in Table 6 demonstrates the effect of overall absorptive capacity on firms’ innovation performance. The coefficient of absorptive capacity is 1.012 and significant at the 0.01 level, meaning that absorptive capacity has a significant positive effect on firms’ innovation performance. Compared to Model 1, the value of R² increases from 0.055 to 0.750, and the adjusted R² value increases from 0.034 to 0.743, which indicates that overall absorptive capacity explains most of the variation in firms’ innovative performance.

The results of the regression analysis are analyzed to test whether the variables related to absorptive capacity have a significant positive effect on firms’ innovation performance. The analysis of each absorptive-capacity-related variable is presented below.

Knowledge acquisition: In Model 2, the coefficient of knowledge acquisition is −0.061, and the t value is −1.545, which indicates that knowledge acquisition does not have a significant impact on firms’ innovation performance. The reason for this is that enterprises have deficiencies in knowledge identification and are unable to identify whether the acquired knowledge is suitable for enterprise innovation.

Knowledge digestion: In Model 3, the coefficient of knowledge digestion is 0.795 and is significant at the p < 0.01 level, which indicates that knowledge digestion has a significant positive effect on enterprise innovation performance.

Knowledge conversion: In Model 4, the coefficient of knowledge conversion is 0.910, and the t value is 22.097, which is again significant at the p < 0.01 level. This finding indicates that knowledge conversion has an extremely significant positive impact on firms’ innovation performance.

Knowledge application: In Model 5, the coefficient of knowledge application is 0.897, with a t value of 22.655, which indicates that it is significant at the p < 0.01 level. This finding means that knowledge application has a highly significant positive impact on firms’ innovation performance.

The model including overall absorptive capacity indicates a significant positive effect of absorptive capacity on firms’ innovation performance, further validating H2. Moreover, by examining the stages of knowledge absorption (acquisition, digestion, conversion, and application) separately, it can be clearly seen that except for the acquisition stage, all other stages have a positive effect on innovation performance. This finding further confirms that absorptive capacity is a key factor in firms’ innovation performance and provides useful insights into how firms can promote innovation by improving employees’ absorptive capacity. In particular, firms should focus on the ability to transform acquired knowledge into practical applications to achieve their innovation goals (Table 7).

In Model 2, the coefficient of digital transformation reaches 0.959, and its t value is as high as 15.118, which implies that there is a significant positive correlation between digital transformation and absorptive capacity at the 0.01 level of significance, which further verifies H3.

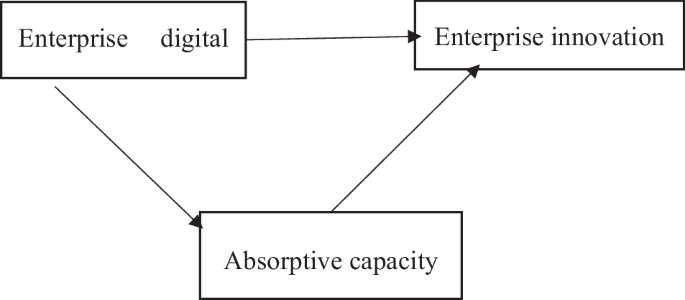

Analysis of the mediating effect of absorptive capacity on the relationship between firms’ digital transformation and innovation performance

The Table 8 is used to test the mediating effect of absorptive capacity on the relationship between digital transformation and enterprise innovation performance. The Table 8 is analyzed in detail below.

Total effect (c path): This indicates the relationship between firms’ digital transformation and innovation performance when the mediating variable (absorptive capacity) is not considered. Its effect is 0.831 and is significant at the 0.01 level. This finding means that firms’ digital transformation has a significant positive effect on innovation performance.

Path a: This is the effect of firms’ digital transformation on absorptive capacity. Its effect is 0.785 and is significant at the 0.01 level, which means that there is a positive relationship between firms’ digital transformation and absorptive capacity.

Path b: This is the effect of absorptive capacity on innovation performance. Its effect is 0.918 and significant at the 0.01 level, indicating a positive relationship between absorptive capacity and innovation performance.

a*b (mediating effect value): This represents the mediating effect of absorptive capacity on the relationship between firms’ digital transformation and innovation performance. The value is 0.720 and is significant at the 0.01 level. The z value is 10.539, indicating that the mediating effect is significant.

The bootstrap confidence interval ranges from 0.522 to 0.793, and since the interval does not contain zero, it further proves that the mediating effect is significant.

In summary, absorptive capacity has a significant mediating effect on the relationship between enterprise digital transformation and innovation performance, which further verifies H4. That is, enterprise digital transformation can improve the absorptive capacity of enterprises, while higher absorptive capacity further promotes enterprise innovation performance. These results show that absorptive capacity fully mediates the relationship between enterprise digital transformation and innovation performance. In other words, enterprise digital transformation improves innovation performance through greater absorptive capacity. Firms’ digital transformation first enhances their absorptive capacity, and then, this enhanced absorptive capacity further drives their innovation performance. This situation provides firms with a strategic direction to enhance their absorptive capacity by strengthening their digital transformation to improve their innovation performance, as shown in Fig. 2.

Regression analysis of the role of network relational embeddedness in moderating digital transformation and firm performance

In Model 1 of Table 9, digital transformation has a significant positive impact on innovation performance. When network relational embeddedness is introduced into Model 2 as another explanatory variable, the direct effect of digital transformation on innovation performance is attenuated, while network relational embeddedness itself has a significant positive effect. In Model 3, an interaction term, the product of digital transformation and network relational embeddedness, is further introduced to test whether network relational embeddedness moderates the effect of digital transformation on innovation performance. The results show that this interaction term is not significant, implying that network relational embedding does not significantly moderate the impact of digital transformation on innovation performance.

In terms of the statistical indicators of the model, the explanatory power of the model (e.g., R^2 and adjusted R^2) increase with the addition of new variables, but the addition of the interaction term does not significantly improve the explanatory power of the model. These results provide firms with insights into how digital transformation and network relational embeddedness independently and jointly affect innovation performance.

Firms undoubtedly need to focus on digital transformation in their pursuit of higher levels of innovation performance. The significant positive impact of digital transformation for organizations means that actively adopting new technologies, optimizing digital processes and training employees in digital skills are all becoming critical in the modern business environment. In addition, network relational embeddedness has positive effects on innovation performance. This finding highlights the importance of enterprises building and maintaining good relationships with suppliers, partners, customers and other stakeholders in the industry or market, as doing so helps facilitate the exchange of information, the sharing of resources and opportunities for collaboration. However, although both factors have a positive impact on innovation performance, they do not reinforce one another. In other words, network relational embeddedness does not enhance or diminish the impact of digital transformation on innovation performance; rather, these factors affect performance independently of one another. Therefore, H5 does not hold, and thus, firms should not expect to gain excess innovation performance by combining these two factors when formulating their strategies but, rather, should optimize and enhance them separately. In addition, given the rapid evolution of markets and technologies, firms should also continuously monitor the relationship between these two factors and innovation performance to ensure that strategic decisions are based on the latest data and trends.

Impact of the digital transformation of Chinese new energy vehicle enterprises on innovation performance #Impact #digital #transformation #Chinese #energy #vehicle #enterprises #innovation #performance

Source Link: https://www.nature.com/articles/s41599-024-03109-y

Impact of the digital transformation of Chinese new energy vehicle enterprises on innovation performance:

Sample descriptionThe manufacturing industry accounts for the largest number of firms in the survey …