Digital Products

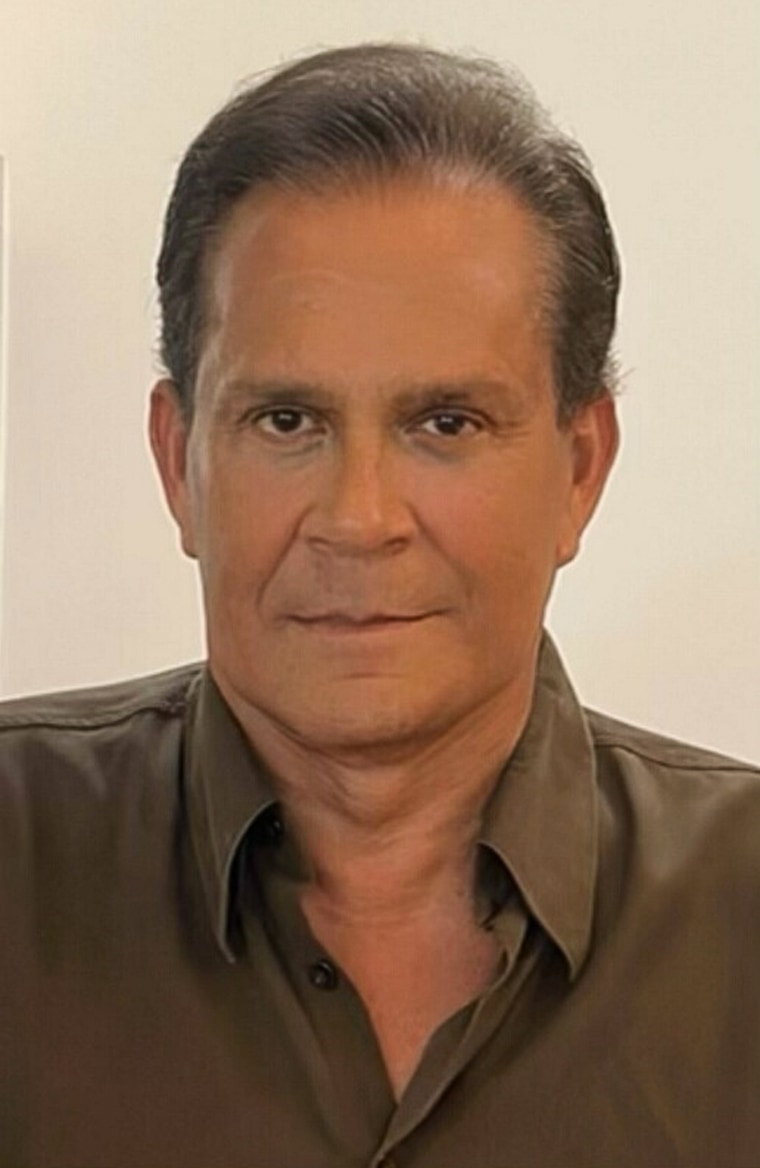

Ted Fitzpatrick is a former TIAA wealth management adviser who was among a small group of TIAA employees who filed an SEC whistleblower complaint against the company in 2016. That filing detailed a previous TIAA campaign to shift client assets into actively managed accounts that generated greater profits to the firm and that incentivized sales representatives to do so. Fitzpatrick, a resident of Milwaukee, received a monetary award earlier this year after the SEC used his information to secure a $97 million settlement from TIAA in 2021. The SEC accused TIAA of failing to disclose the conflicts in the asset-shifting campaign; TIAA neither admitted nor denied the allegations, in which the New York attorney general was also involved.

“It’s frustrating to see that TIAA doesn’t view their customers’ money as a sacred thing,” Fitzpatrick said, after reviewing the new allegations. “They are worried about surviving.”

The company’s ‘engine’

TIAA’s business has two main parts: First, it acts as recordkeeper for the retirement plans of institutions like Cornell University, the University of North Carolina System and most of the nation’s 107 historically Black colleges and universities. Second, TIAA earns money as an asset manager on in-house mutual funds and insurance products sold to investors both inside and outside those plans. Annuities are contracts that promise to provide income for holders during their lives.

While most of TIAA’s clients are current or retired workers at nonprofit organizations, TIAA also offers individual retirement accounts to investors online.

Most of the institutional accounts handled by TIAA allow participants to invest both in its own products and also in funds from outside firms like Vanguard or Fidelity. As is typical across Wall Street, selling in-house products generates significantly greater profits to TIAA than sales of external offerings.

Revenues that accrue to TIAA from its product sales are not always clear to investors. For example, TIAA Traditional, its popular annuity, does not have an “identifiable ‘expense ratio’ or ‘fee,’” the company says. Chris Tobe, an expert in pension investments and a former trustee of the $14 billion Kentucky Retirement Systems, said the industry consensus is TIAA makes around 1.2% on TIAA Traditional, far more than other types of investments. Craig Parkin, the firm’s head of retirement advice and consulting, described TIAA Traditional as the company’s “engine” in the recording of a sales meeting last fall.

The problem for clients arises when TIAA products promoted by its sales representatives or its advice tool cost more than its competitors’ or perform poorly by comparison. An example is a TIAA real estate product the advice tool funnels clients to — it has significantly underperformed an index of real estate investment trusts in six of the past 10 years and is down 4.6% in 2024 while the index is up 4.2%.

When Rajotte made his presentation to TIAA employees, he cited Yale University’s retirement plans as an example of how TIAA compensates for its losses elsewhere by selling in-house products. At Yale, he said, “we’re more than making up for the loss in recordkeeping revenue by what we’re making in the product side.”

Asked if Yale was concerned about TIAA’s in-house products being pushed on its participants to offset losses, the university said in a statement: “Neither Yale nor any of its plan fiduciaries has access to TIAA’s internal business discussions, nor is it Yale’s role to monitor TIAA.”

Yale’s statement went on to say that those overseeing its retirement plans are fiduciaries who “retain independent investment advisers, who are also fiduciaries to the plans, to provide expert assistance in identifying suitable investment funds and monitoring their performance. The plan fiduciaries periodically evaluate whether the investment fund fees that the plans pay TIAA are reasonable.”

If a financial firm advises customers to buy in-house investments that make it more money than other vehicles, it must disclose that fact. Ditto if a firm rewards sales representatives with higher compensation for directing clients into certain investments.

TIAA hasn’t always done this. In the 2021 SEC case, some TIAA training materials encouraged the firm’s wealth management advisers to avoid discussing with clients the fees and expenses associated with shifting their low-cost employee retirement accounts into higher-cost managed accounts. TIAA misled clients by characterizing the recommendations to move into managed accounts as objective advice, according to the SEC. The activities occurred from January 2013 through March 2018; in accepting the settlement from TIAA, the SEC said it considered remedial actions the company took before and after the investigation, including changes to its disclosures, training, policies and compensation structure.

In that case, TIAA also tried to propel clients into making investment choices that would benefit the firm by citing the possibility that they would not have enough money to retire, the SEC said. “Making the Client Feel the Pain,” was how TIAA’s scripted sales materials characterized the approach. TIAA said in 2017 that the language in those materials did not reflect the company’s values.

The recent push at TIAA, according to the whistleblower complaint, differs from the 2021 case by focusing on its financial consultants, the employees who work directly with institutions like Brown University and Harvard.

Ted Siedle is a former SEC enforcement attorney who represents the former TIAA employee filing the recent complaint. He also represented Fitzpatrick and his colleagues whose information led to the 2021 SEC case.

“TIAA changed its practices after the SEC brought the 2021 enforcement action, but the new whistleblower’s information indicates the firm is again putting its interests ahead of clients,” Siedle told NBC News. “Unfortunately, recidivism exists on Wall Street.”

No disclosure

At a meeting last fall, TIAA’s Parkin told financial consultants that 655,000 of the firm’s clients were “off track” for retirement.

Why the dire situation for so many TIAA clients? They didn’t own enough in-house TIAA products, according to the complaint and a recording of Parkin’s presentation. Propelling these folks into TIAA Traditional, the annuity, would get them on track, he said. Even better, it would generate $10 billion for the firm, Parkin said.

Getting clients to use TIAA’s online advice tool was the means to this end, Parkin said on the recording. He also said TIAA’s CEO, Thasunda Brown Duckett, and others in the executive suite supported his strategy as a top priority to be pursued immediately. “Thasunda loves her money,” Parkin said on the recording.

NBC News described in detail to TIAA the statements made by Parkin and Rajotte on the recordings. The firm declined to comment but did not deny them. TIAA declined to make any executives available for an interview.

Like many online advice mechanisms, TIAA’s Retirement Advisor Field View Tool recommends clients balance their portfolio among various asset classes — stocks, bonds, money markets and the like — based on risk tolerance, age, income and other inputs. The tool divides investors into seven types — very conservative to very aggressive — then steers them to investment options in each asset class, internal documents show. Clients using the tool to change their portfolio must accept all its suggestions; a participant cannot accept one recommendation on stocks and reject another on real estate, for example.

Most of the asset classes available for users of the tool include an array of investment options that include both TIAA products and those offered by competitors. The company’s spokesman said more than 2,500 non-TIAA funds are available to retirement plan sponsors for selection through its recordkeeping platform.

But in two asset classes, the tool’s recommendations are limited to TIAA products, according to the complaint and internal documents. One is the annuity that Parkin said generates significant profits to the firm; the other is the lackluster TIAA real estate product.

In order for the tool to recommend these products, they must be on the menu of investment options available for a client to choose from under the client’s TIAA plan. The whistleblower said they are ubiquitous in the option lineups of investment plans that employ TIAA as recordkeeper, indicating that those participants would likely be directed into both investments.

TIAA declined to say how many plans have the two products in their lineups, saying only that “many” do not.

Clients receive no specific disclosure when they use the tool that those two categories contain only TIAA investment options, the complaint states. Neither are users of the tool advised that some of their financial consultants’ bonuses are tied to persuading a set number of clients to use it.

Asked about its disclosures related to the tool, TIAA said in a statement: “We disclose conflicts of interest, where they exist, in connection with the sale of proprietary products and compensation.”

TIAA declined to say when its disclosures are provided to clients, such as if they are provided at the time the client uses the tool to change their investments. Among the firm’s broad disclosures on its website are those saying TIAA has a financial interest in recommending clients purchase its annuities and financial consultants’ bonuses create a conflict of interest when those consultants recommend TIAA products.

All seven investor types using the tool, aggressive or conservative, are steered to put 8% or 9% of their portfolio into the TIAA real estate vehicle, internal documents from late 2023 show. And all but one of the seven investor categories are funneled to the TIAA annuity. Depending on the risk category, clients are advised to put between 7% and 40% of their portfolios in the annuity.

On its website, TIAA describes the tool as providing “unbiased investment recommendations from an independent third-party.” That third party is Morningstar Investment Management LLC, a well-known provider of investment research, data and news.

TIAA says plan sponsors like Yale or their consultants decide which investments are offered to participants using the tool. However, TIAA does say in promotional materials discussing it: “We accept fiduciary responsibility for the investment advice offered.” A fiduciary has an obligation to put clients’ interests ahead of its own.

“The tool is designed to follow the Department of Labor’s Advisory Opinion 2001-09A that allows a company to give investment advice to plan participants with respect to proprietary investments or third-party investments that generate fees if that advice is developed by an unrelated financial expert,” TIAA said in a statement. Morningstar, a third-party independent registered investment adviser, is “the financial expert that generates the investment allocation advice and selection of asset classes for the advice and education supplied by the tool.”

A spokeswoman for Morningstar Investment Management counters that it does not determine whether an asset class, such as “guaranteed” or “real estate,” is included in the tool’s choices. Morningstar selects asset classes and investments for the TIAA tool from those chosen by a retirement plan fiduciary, it said.

“TIAA retains the fiduciary responsibility to the participants because RAFV is TIAA’s tool, where they control the user interface, the data points collected for input to the tool, and the data points in the output provided to the participants,” a statement from Morningstar said. “Morningstar Investment Management does not have advisory agreements with either the plans or the participants using RAFV. It is not involved with TIAA’s sales practices and does not benefit from the volume of participants using the RAFV tool.”

Individual retirement account customers using the TIAA tool to change their portfolio outside of an institutional plan are also swept into TIAA real estate and the annuity, said the former employee, who produced recent client documents showing this. A TIAA disclosure notes that its IRA recommendations generally “are limited to affiliated products” that pay TIAA compensation and are more costly for investors than alternatives.

$18.2 million in pay

In an effort to ensure its clients make changes the tool recommends, last year TIAA began a new incentive setup, the complaint contends. While previously consultants had been encouraged to discuss the tool’s recommendations with clients, now the employees are tasked with getting a certain number of clients to implement the tool’s advice. If a consultant persuades at least 170 customers to make changes using the tool, he or she earns credits toward bonuses accounting for one-quarter of their compensation.

TIAA said it has minimum performance standards and goals for its financial consultants “to ensure consistency in participant experience and that baseline expectations of the role are achieved.”

Top TIAA executives also reap rewards when more money flows into its annuity, the company’s compensation report shows. Almost half of the pay granted to TIAA’s top executives last year — 45% — was based on the firm’s financial performance; growth in inflows to TIAA Traditional is one of five measures the firm’s human resources committee uses to determine that.

Pay at the top of TIAA is generous. Together, its top five executives received $46.2 million last year, with Duckett, TIAA’s CEO, receiving $18.2 million, up from $17.5 million the prior year. Of the 18 companies TIAA considered to be peers for pay purposes last year, Duckett received more than CEOs at 10 of them, including Bank of New York Mellon, Equitable Holdings and T. Rowe Price.

Put another way, TIAA, which operates without profit, paid its CEO more than the CEOs at most of the for-profit companies it says are peers.

TIAA’s spokesman said that Duckett’s compensation was set by the TIAA board of trustees based on the company’s performance.

The recent push to increase client usage of TIAA’s advice tool appears to be succeeding. Last fall, TIAA executives sent a congratulatory email to financial consultants noting that “advice implementations” using the tool were up 34% year over year, a copy shows. More than $400 million in new money flowed to TIAA Traditional as a result, the email said.

While TIAA’s in-house products generate significant revenues and profits to the firm, it’s not always so for clients. Last year, for example, the TIAA real estate offering was down 13.6%; it is down 4.7% year to date.

Other real estate funds have done better. One managed by Cohen & Steers is up 9.35% for the past 12 months and averaged a 5.8% gain in each of the past five years. Here’s how these returns affect investors: If a plan participant had invested $15,000 in the TIAA offering and added $100 each month, she would have generated about $60,000 over the past 15 years. If she invested $15,000 in the Cohen & Steers fund and contributed an additional $100 each month, she would have had $151,000.

TIAA says its real estate product offers “potentially lower volatility” than other investments in the sector and “guaranteed, daily liquidity.”

‘Somebody stood up’

Until now, Fitzpatrick, the previous TIAA whistleblower, has not spoken publicly about his experience helping the SEC and New York state investigation. TIAA declined to comment on Fitzpatrick’s allegations, which NBC News shared with the firm.

In a phone interview, Fitzpatrick recalled joining TIAA in 2013 because the firm said it held itself to a higher standard than other Wall Street outfits and always did what was in its clients’ best interests. “That’s all I wanted from an employer,” he said.

“This is another interesting item!”

“TIAA has faced financial challenges in recent years as teachers and others have opted for lower-cost retirement investments. A whistleblower and a recording of a sales meeting indicate TIAA is…”

Source Link: https://www.nbcnews.com/investigations/tiaa-pushes-costly-retirement-products-cover-losses-whistleblower-rcna161198

#DigitalProducts – BLOGGER – DigitalProducts